I was expecting a cheer as loud as a sonic boom, but if there was one, I must have missed it. We (Indians) are so good at debating that time is never of the essence, accordingly, the 31st October deadline for submission of the draft rules by each of the States and Union Territories has been pushed to 31st March 2017. As a consumer, I would have thought that RERA would have forced the creation of a uniform law with uniform standards across the nation so that I could purchase real estate anywhere without having to keep track of the hundreds of exceptions and differences that pop up from State to State. You guessed it; as always, a new law is born, but the old ones on the same subject haven't been killed yet. Parallel laws means use and abuse of all. As a result, each State has the prerogative to frame its own set of REAR rules based on the offered guidelines. Why? The wisest answer I have heard is that a uniform code will shake the boat a bit too much for a seamless shift. Moreover, one has to account for local nuances, after all, even God in his infinite wisdom did not create equal sized fingers for the same hand.

In any event, something is certainly better than nothing I suppose. Once in force, starting May 2017, I as a consumer and the highest risk taker, do have the following rights across the length and breadth of this Country:

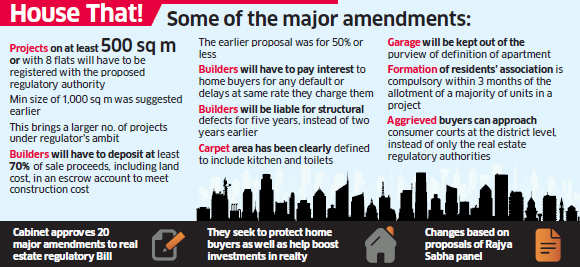

1. All projects new and old (incomplete) shall have to register with a RERA prescribed Competent Authority. Exceptions... trust me there are, allowing existing projects to escape the net.

2. The builder/developer (B/D) shall park 70% of the payments received from the buyer in an earmarked escrow account and draw funds proportionate to completion schedule and used only for that specific project. You will not like it. If the builder has purchased the land then the land cost may be drawn from the advanced amount. This is such a laugh knowing that land accounts for more than 50% cost in most projects and the builder's completion schedule collects 85% on the completion of RCC structure itself, leaving only 15% for finishing the building.

3. A (B/D) shall not market the project before receiving all requisite permissions to commence construction and completion of the project. Factually, a builder/developer gets only temporary permissions to build a certain portion of the overall permissible construct area in order to monitor the quality and quantity constructed has not violated norms. So does the (B/D) have a right to market the entire project up front?

4. A (B/D) cannot handover a unit as complete without obtaining the completion/occupancy certificate so as to ensure that the buyer has purchased a fully compliant unit with the requisite utility connections. Delays will cost B/D interest and/or penalties which could include imprisonment. If followed to the tee, I can visualize (B/D) being bullied by those with the power of the pen to jump off from the highest terrace or pay up special fees for accepting their claim.

5. Units would be sold on the "carpet" area basis, would come with a 5 year no-defect warranty, and title insurance. Great. the definition of carpet area is different from State to State; the warranty clauses would be so tightly worded that even a single nail to hold a photo frame would void it; and title insurance, no insurance company has had the guts to even propose it until now.

Oh! I forgot. By Country I meant its urban areas only. So most of Goa, where development is regulated by the "panchayat" is out of the RERA ambit. Can I as a consumer be blamed for my stoicism?

Yes, it's trying to do good, including making it mandatory for brokers to accept responsibility for the goods they hawk as well. A broker cannot earn fees for a service that can be described as "introduction". The brokers would henceforth have to register themselves, prove a level of knowledge competence, and do their own project due-diligence before going out in the market as salespersons. The view from this set of people is that the effect of RERA will drive up costs and lower sales in an already hurting industry.

The B/D community is livid though. It feels that RERA is completely one sided. From its point of view, the government may as well shut down private real estate development and hand it over to the public/social sector. On one hand RERA seeks to address consumer oppression by the few rotten eggs in the B/D community, but there is no recourse for the good apples in B/D fraternity from the ever increasing choking grip of those wielding the pens of permission, greedy politicians, the underworld as well as the supply chain mafia. It's easy for the world to generalize and label the entire B/D world as profiteering blood suckers, but is there a realization how many fronts its has to fend from buying land to clearing it of encroachments and title defects; from getting approvals for site development to utility and infrastructure connections; from procurement of construction material to meeting with a plethora of changing environmental regulations; not to mention meeting the demands of all the silent partners without whose forced protection the projects would never see completion date. Yeah! it's a hard life and a ride in a Bentley or Rolls is just a small incentive to endure all this crap.

True, those who were in just for the joyride of power, prestige and profit have started jumping ship. Independent Directors of many listed and unlisted RE companies have sent in resignations; Private Equity has started rewriting contract terms to distance itself from being classified as developer/promoter even in the quasi sense; Non Banking Financial Corps (NBFCs) rediscovering their core objectives as retail lenders and not mezzanine financiers to projects. The biggest worry for any builder/developer today is that would the concept of "off-plan" sales just disappear in favour of finished goods?

The 70% escrow clause may just shut off some of the marketing gimmicks like the 10:80:10 or such permutations and combinations where the consumer was suckered to lend his/her balance sheet to the builder for cheap debt. Funds for project - be it debt or equity would be an issue, a big one, specially with the RERA applicable uncertainties. The demon of demonetization may have skipped the clever rich, but the average buyer having less than the required share of common sense has been impacted enough to shy away from squandering the ill gotten wealth on buying "invisible" property. Reporting norms will make it tough to conceal facts from anyone. The funding community has a different take. "Crocodile tears" is what they call it. If nations like the UAE can work with consumer protection laws similar to RERA, and the very same who complain here thrive there, then there is something wrong.

First, the concept that anyone can become a builder/developer must go. Lot of fallen and badly constructed buildings support that view. The 'Bentley" builder must give up greed and deploy profits in development rather than land grab to create an artificial scarcity. The industry needs and will see more organized - strong balance sheet players who can take on the might of those who abuse their power in an unjustified manner.

Hey! did anyone mention GST in all this? No, cause conveniently, it's a pass through tax and the consumer will bear it with a forced grin. They asked for "Acche Din" with GST and they got it good. The B/D guys are only upset that it will not enjoy the benefit of claiming back some of that tax.

While RERA may have set many a rectums roaring, will the purge be good for all in the long run? Unlikely- why?

Will RERA or GST or the kill bill on black money affect the RE sector? Unlikely.

Will it impact prices downward? Unlikely.

Will it protect the consumer? Unlikely.

Will it punish those who unnecessarily hold up project clearances? Unlikely.

Will it bring down corruption? Most Unlikely?

Will it discipline the players of this segment including consumer? Unlikely.

The reason was right there at the start. It's just another layer of fabric that fails to address the basic issue of uniformity or transparency either coherently or comprehensively at a national level. To that extent the B/D community is right in saying 'Why just us? Make those who regulate this industry accountable too."

I pray to be proven wrong.

|

| Pic Credit: Economic Times |

No comments:

Post a Comment